“There is all the difference in the world between having something to say and having to say something.” -John Dewey: Was a psychologist, educator and social critic

FANNIE TO FINE LENDERS FOR FORECLOSURE DELAYS

Mortgage servicers who have delayed the foreclosure process for delinquent borrowers may now get fined. Fannie Mae announced it will retroactively fine mortgage servicers for failing to process severely aged loans in foreclosure, HousingWire reports.

Fannie Mae would not disclose the amount of the fees, but the fees are to be “based on the outstanding principal balance of the mortgage loan, the applicable pass-through rate, the length of the delay, and any additional costs,” HousingWire reports.

The government-sponsored enterprise updated its time frames for mortgage servicers for navigating the foreclosure process last August.

“A compensatory fee not only compensates Fannie Mae for damages but also emphasizes the importance placed on a particular aspect of the servicer’s performance,” according to guidance for Fannie Mae from its regulator, the Federal Housing Finance Agency. “In some cases, a compensatory fee will relate to the action the servicer took, or failed to take, in handling a specific mortgage loan. At other times, the compensatory fee reflects the impact of the servicer’s performance deficiencies on Fannie Mae’s cash flow.”

5 QUESTIONS TO ASK WHEN EVALUATING SHORT SALES

“Mortgage lenders across America are eager to avoid foreclosures, and short sales can be an attractive option for clients and real estate professionals alike,” writes Bill Ervin, the national sales director of real estate relationships for CitiMortgage Inc., in an article at RISMedia. “Ask the right questions and you’ll be well on your way to a successful short sale.”

Here are some questions Ervin points out are important for real estate professionals to consider when evaluating a potential short sale for a client.

1. Who owns the lien according to the servicer?

2. What documents are required? For example, the transaction always requires a Letter of Authorization (which is from the client authorizing the real estate professional to speak on their account); listing agreement; purchase contract; estimated/final HUD Settlement Statement; and 2nd Lien Approval Letter.

3. Do all of the parties agree on the property’s value?

4. Has the seller signed a short sale agreement?

5. What are the major challenges the client may face in this transaction? (For example, are there subordinate lien holders or will the client be able to secure financing in time?)

PENDING HOME SALES RISE IN MAY

After an April dip, pending home sales rose sharply in May, for the first annual increase in over a year, according to a report from the National Association of Realtors.

NAR’s Pending Home Sales Index rose 8.2 percent month-to-month and 13.4 percent year-over-year in May, to 88.8. An index score of 100 is the average level of contract activity in 2001, the first year that index data was collected. May saw the first year-over-year index increase since April 2010, NAR said.

The index, which tracks homes under contract, is a leading indicator, and the latest data suggest home sales will jump in June and July.

“Absorption of inventory is the key to price improvement,” said Lawrence Yun, NAR’s chief economist.

He cautioned, however, that “the job market has sputtered recently, and because variations in local job creation impact housing demand, markets will recover unevenly around the country.”

Pending sales jumped in all regions last month. The Midwest saw the biggest year-over-year increase, 17.2 percent, and the second-biggest month-to-month increase, 10.5 percent, to 82.8.

In the South, the index rose 14.6 percent year-over-year and 4.1 percent month-to-month, to 95.

The West saw the biggest month-to-month increase, 12.9 percent, and a 13.5 percent year-over-year increase, to 100.6.

The Northeast was the only region that did not experience double-digit increases. Pending sales in the region rose 4.4 percent year-over-year and 7.3 percent month-to-month, to 69.2.

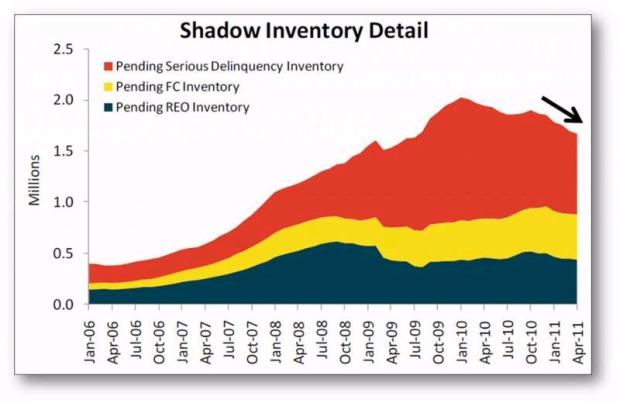

HOUSING MARKET CASTING A SMALLER SHADOW

The inventory of future short sales and foreclosures which will be coming to the market is known as ‘shadow inventory’. Future real estate pricing will be determined by the number of these distressed properties which eventually reach the market.

These properties sell at major discounts:

- short sales at a 10% discount

- foreclosures at a 35% discount

CoreLogic just reported this inventory is declining as more Americans are staying current on their mortgage obligations. Here is a graph from their latest report:

Bottom Line

There still are a substantial number of distressed properties that must be cleared. They will cause prices to soften in many markets. However, it is comforting that this number is finally beginning to decline.